UK Export Finance (UKEF) in collaboration with the Open Innovation Team and the University of Southampton has developed a proof of concept for issuing UK Government guarantees to support exporting on a blockchain.

What problem are we trying to solve?

At UK Export Finance our mission is to ensure that no viable British export fails for lack of finance or insurance, while operating at no net cost to the taxpayer. Blockchain networks present an opportunity to better serve the UK exporter with government backed trade finance products because these kinds of transactions require close collaboration between the banks and government.

The current model is a linear process that can result in inefficient back-and-forth of data reconciliating

With the current technical architecture, transaction information is held separately by both the bank and UKEF. This results in inefficient data reconciliation activity and means that the exporter has to wait for their application to go through the assessment processes of their bank first and then UKEF before they know whether they have been successful. Additionally, the exporter is reliant on their bank knowing about and efficiently using UKEF’s services to access the government support that they may be eligible for.

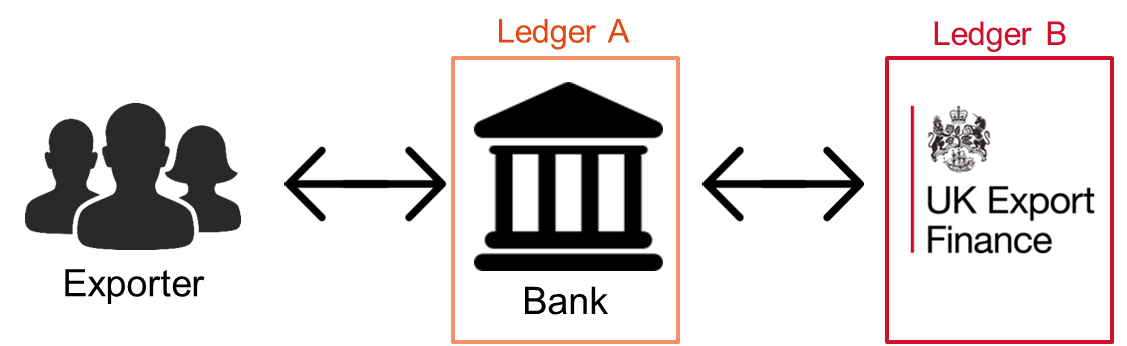

Blockchain solutions offer an alternative model for government collaborating with financial institutions. The blockchain technical architecture allows transaction partners (in this case UKEF and a bank) to work from a common, distributed ledger.

The model offered by blockchain technology provides a shared, distributed transaction ledger that all parties can use as a basis for their operations

The prototype

Having considered the use-case for blockchain, the project team elected to develop a simplified bond support service. The prototype, built by Andrea Margheri at the University of Southampton, was structured based on the assumption that there would be three main actors in a bond support deal submitted to UKEF:

- The Exporter

- The Bank

- UKEF

Of the available trade finance focussed blockchain solutions, the team selected Corda as the technical solution upon which to base the prototype. The Corda blockchain framework is a solution designed for decentralised financial processes, offering transactional multi-actor distributed workflows. On top of typical blockchain data storage, it provides:

- user authentication;

- smart contract-based interactions;

- selective data visibility

This means that UKEF, the banks and the exporting business can control what data they want to share with the other parties in the transaction but hide data that could be commercially sensitive.

The prototype build allowed the exporter to enter an application for a bond with the bank. The bank and UKEF are made aware of this. The bank and UKEF could then perform their various credit and risk checks and make their decision on whether to support the application.

This presents the opportunity for UKEF to indicate whether the government will support the transaction. At present this will always occur after the initial application via the bank often resulting in inefficient back-and-forth between the bank and UKEF. The approach offered by the prototype means that UKEF could indicate that the department is willing to support the transaction earlier in the process.

The prototype demonstrates how a digital service built to this architecture can enable UKEF and banks to run more efficient operational flows. This could allow greatly reduced waiting times for UK businesses applying for crucial support to satisfy their export activities.

Why not simply deploy APIs to achieve similar benefits?

The significant benefits demonstrated by the blockchain prototype are derived by using a distributed ledger to enable earlier and more effective sharing of data between organisations. A natural question to ask, however, is could these same benefits not be realised using automated data flows between the banks and UK Export Finance? The answer to this is that it may be possible, and it may be the most appropriate solution in certain scenarios. However, creating effective APIs that will work for UKEF and all the banks we partner with to cover a variety of different transactions is not a trivial task. Blockchain technology is another tool in the box to help UKEF continue to improve the support it provides British exporters. The prototype project we delivered with the University of Southampton and the Open Innovation Team has given us the opportunity to build blockchain capability within the department and to better understand what the technology has to offer.

As UKEF continues to evolve its services to meet the challenges and grasp the opportunities of the future it is important that we continue to explore and understand emergent technologies.